The Rise of Dry January

Dry January has evolved from a niche health trend into a mainstream consumer behavior shift that directly impacts the beverage industry.

For the traditional alcohol industry, Dry January often results in a temporary decline in sales, prompting brands to rethink their marketing strategies and product portfolios. Conversely, the non-alcoholic beverage sector, particularly non-alcoholic beer, experiences a surge in demand.

This trend is not confined to January alone—data suggests that Dry January serves as an entry point for long-term changes in drinking habits, further fueling growth in the no- and low-alcohol category.

While many in the non-alcoholic world focus heavily on the success of the industry, it’s important to examine the broader economic impact of Dry January, analyzing its effects on alcohol producers, retailers, hospitality businesses, and the expanding non-alcoholic beverage sector.

The Origins of Dry January

The concept of a “Dry January” actually started gaining traction when a woman named Emily Robinson signed up for her first half marathon in February 2011.

She decided to give up alcohol for January as part of her training. Seeing how great she felt, she joined Alcohol Change UK in 2012 and pitched the idea of turning this personal challenge into a broader campaign.

Photo Cred: Food Times

In 2013,

In its first official year, around 4,000 people participated. It was relatively modest, but the buzz around it grew quickly. By 2020, over 4 million people in the UK alone reported participating in Dry January.

It’s since expanded globally, with various countries and cultures adopting their own versions or embracing the idea as part of a broader sober-curious trend.

The Consumer Shift Towards a Dry Life

Dry January aligns with a larger cultural movement toward health-conscious consumption and mindful drinking. Key drivers include:

- Wellness and Lifestyle Shifts – Consumers are prioritizing physical and mental health, leading to greater scrutiny of alcohol consumption.

- Rise of the Sober-Curious Movement – A growing segment of consumers is moderating alcohol intake without necessarily abstaining completely.

- Increased Accessibility to High-Quality Alternatives – Unlike in previous decades, today’s consumers have access to premium non-alcoholic beer, spirits, and cocktails that replicate the taste and experience of traditional alcohol.

Studies show that more than half of Dry January participants continue to drink less alcohol in the months that follow, highlighting long-term shifts in consumption.

The non-alcoholic beer market has grown by over 30% year-over-year, with Dry January serving as a peak sales period. In January 2024, sales of no- and low-alcohol drinks surged, with weekly velocity increasing by double digits throughout the month compared to the average.

These factors indicate that Dry January is no longer just a seasonal trend—it represents a broader change in consumer habits that has lasting effects on the beverage industry.

Dry January’s Impact on the Beverage Industry

January has historically been a slow month for alcohol sales, but Dry January intensifies this trend. Studies show that beer, wine, and spirits sales can decline by 15-20% in January compared to the holiday season. This drop is felt most strongly by bars and restaurants, which rely heavily on alcohol revenue.

Shift in Alcohol Marketing Strategies

Retailers and alcohol brands have taken notice of this shift and have adjusted their strategies accordingly.

Some brands choose to market “healthier” alcoholic options, such as low-ABV beers and organic wines, while others have started embracing non-alcoholic alternatives.

Instead of viewing Dry January as a threat, many companies now see it as an opportunity to engage with a growing customer base that values moderation and balance.

In a recent article by Northeastern Global News, Malcolm Purinton, an assistant teaching professor of history at Northeastern University who studies the history of beer, brewing, technology and trade, commented on Dry January:

“Prohibition lasted for a solid 10 or so years, and a lot of the major companies … came out of it pretty well because they were able to diversify their portfolio, including making near beer that was near to beer but didn’t taste nearly as good as the options today.”

Impact on Bars, Restaurants, and Retailers

Bars and restaurants often face challenges during Dry January, as alcohol sales typically contribute significantly to their revenue. To counteract this, many establishments are adapting by offering more alcohol-free options.

The days of simply offering soda or water as an alternative are over—today, many venues have NA beer selections, alcohol-free cocktails, and sophisticated zero-proof drink menus.

Retailers, on the other hand, have been quick to capitalize on the non-alcoholic trend.

Large chains like Whole Foods and Total Wine now stock a wide variety of NA beverages, and online retailers specializing in alcohol-free products have seen significant growth.

E-commerce platforms selling NA beer and spirits report record-breaking sales in January, indicating that consumers are actively seeking out these products.

The Growth of Non-Alcoholic Beverages

While traditional alcohol sales slow down, the non-alcoholic beverage industry thrives during Dry January. Non-alcoholic beer, in particular, has seen tremendous growth in recent years.

Brands like Athletic Brewing, Heineken 0.0, and Guinness 0.0 have gained popularity, offering high-quality alternatives that appeal to consumers looking for a great tasting, alcohol-free option.

Data shows that NA beer sales spike in January, often increasing by 30% or more compared to other months. This trend extends beyond beer—non-alcoholic spirits, hop water, and functional beverages like adaptogenic drinks are also seeing increased demand.

Grocery stores and liquor retailers have expanded their selections, dedicating more shelf space to non-alcoholic products in response to consumer interest.

A Lasting Shift in Consumer Behavior

One of the most notable impacts of Dry January is its long-term influence on consumer habits.

Many participants report that they continue drinking less alcohol even after the challenge ends. Instead of returning to their pre-January consumption levels, they incorporate NA options into their regular routines, leading to sustained demand for non-alcoholic beverages.

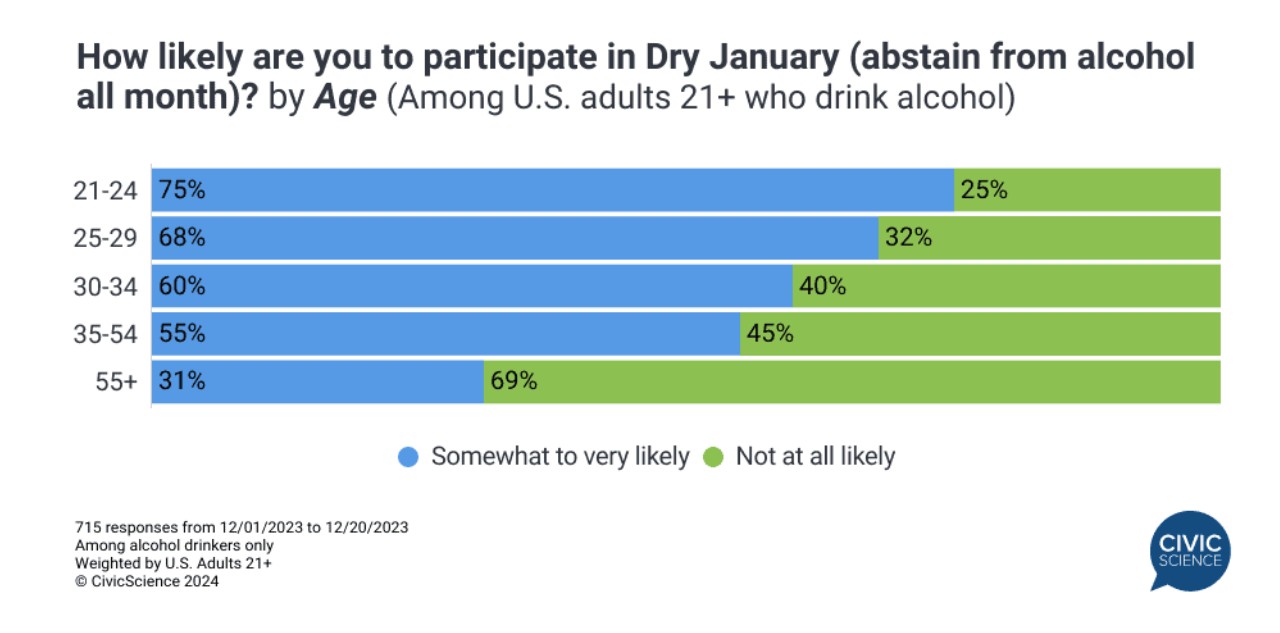

Back in a 2023 study, 75% of Gen Z adults aged 21-24 stated that they were at least ‘somewhat likely’ to participate in Dry January. This is the largest age demographic to do so, and that percentage has most likely gone up.

This shift has encouraged breweries, distilleries, and beverage companies to invest further in the no- and low-alcohol (NOLO) market. As a result, we are seeing more innovation in the space, from craft breweries producing NA IPAs to bars specializing in alcohol-free experiences.

The perception of non-alcoholic drinks has evolved from being seen as a substitute to being a legitimate category of its own.

A Dry Future

Dry January is more than just a temporary abstinence challenge—it is a driving force behind fundamental changes in the beverage industry.

While alcohol sales experience a seasonal dip, the non-alcoholic beverage sector continues to grow, reshaping consumer preferences and market dynamics.

For businesses, the key takeaway is clear: non-alcoholic options are no longer an afterthought—they are an essential part of the modern drinking experience.

As Dry January continues to gain momentum each year, companies that recognize and adapt to this shift will be well-positioned for future success.